67% CAPITAL GAINS TAX IN CANADA IS COUNTER PRODUCTIVE

Dear Canada: 67% Capital Gains Tax?!

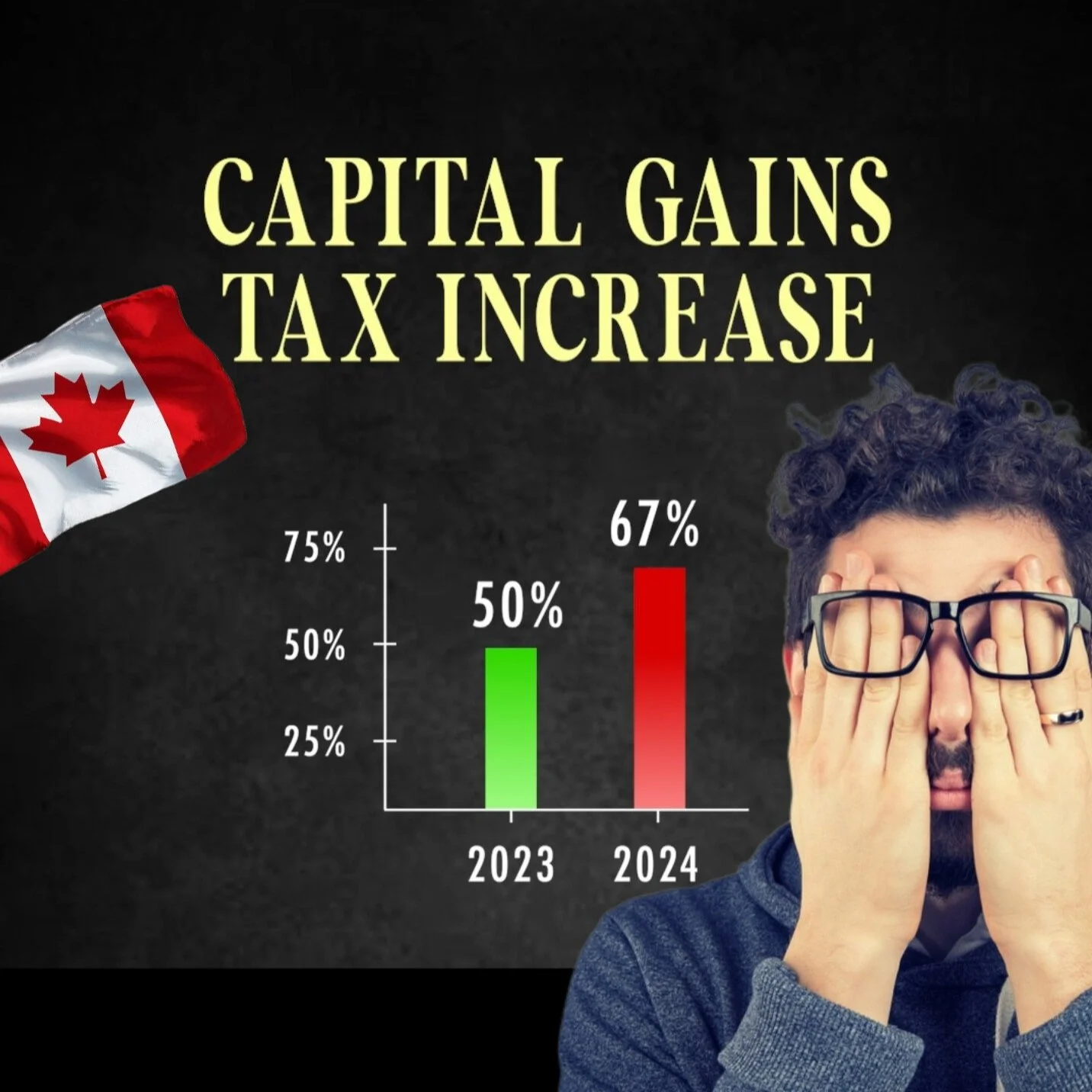

Recent news has sparked concern over a potential increase in Canada’s capital gains tax from 50% to 67% on earnings above $250K. As a business owner, I can’t help but wonder about the implications of this change. This increase, which also applies to corporations, is intended to generate more revenue for the government, but it could have significant consequences.

From my perspective, this move could serve as a major deterrent for both foreign investors and Canadian businesses. Higher taxes on capital gains might slow down growth and innovation, making it less appealing for entrepreneurs to invest in Canada. The impact stretches beyond personal finances—corporations too will feel the pressure of paying a larger portion of their gains in taxes, potentially limiting their expansion and job creation capabilities.

This is not a matter of political debate between Liberals and Conservatives. Instead, it’s about how much of our hard-earned money we’re willing to give away and how these policies could shape Canada’s economic future. Is this the right path to take? How will it affect our ability to compete on a global scale?

As someone considering further expansion in Canada, these new rules are certainly making me think twice about investing in resources like land, warehousing, and people. It’s essential to ask ourselves: How much are we willing to sacrifice in terms of growth and investment opportunities for the sake of government revenue?

What are your thoughts on this? Let's start a conversation!

“This move could serve as a major deterrent for both foreign investors and Canadian businesses. Higher taxes on capital gains might slow down growth and innovation, making it less appealing for entrepreneurs to invest in Canada. ”

Making it less appealing for entrepreneurs to invest in Canada.

WHY DID CANADA PASS THE NEW CAPITAL GAINS TAX LAW?

Canada's decision to increase the capital gains tax rate from 50% to 67% stems from several economic and political factors. Primarily, the government is seeking to increase revenue to address growing deficits, particularly in light of significant spending during and after the pandemic. The increase is also seen as a way to address wealth inequality, as capital gains taxes disproportionately affect individuals with higher incomes who benefit from investments.

Additionally, there is political pressure to align tax policy with more progressive goals, including wealth redistribution and reducing the burden on middle- and lower-income Canadians. Raising the capital gains tax on earnings above $250,000 targets the wealthiest individuals and corporations, with the hope that the additional revenue can be channeled into public services, infrastructure, and social programs.

While the government argues that this tax hike is necessary for long-term fiscal sustainability, critics argue that it could deter investment and growth, particularly in sectors that rely on capital investments. The new law could also make Canada less competitive on the global stage, as investors might seek more favorable tax environments elsewhere.

In summary, Canada passed the new capital gains tax law to raise revenue, address wealth inequality, and sustain public spending, but the move has sparked concerns about its potential impact on investment and economic growth.

DIFFERENCE BETWEEN CONSERVATIVE AND LIBERAL/SOCIALIST POLICIES?

Conservative vs. Liberal/Socialist Policies: A Comparative Overview

Conservative Policies:

Economic Freedom: Conservatives tend to prioritize free markets and limited government intervention in the economy. They believe that reducing taxes, cutting government spending, and deregulating industries encourage private enterprise and entrepreneurship, which in turn leads to economic growth.

Taxation: Conservatives advocate for lower taxes, especially for businesses and higher-income individuals, arguing that this stimulates investment, job creation, and overall economic growth. They prefer a trickle-down approach, where wealth generated by the upper class benefits the broader society.

Role of Government: Conservatives emphasize limited government. They believe that government should play a minimal role in everyday life and business, and that individual freedoms and responsibilities should be prioritized over government control.

Social Issues: Conservatives often support traditional values. This includes positions on family structure, marriage, and religious freedom. They may oppose liberal policies on issues such as abortion and LGBTQ+ rights based on moral or religious grounds.

National Defense: Conservatives typically advocate for a strong national defense, supporting higher military spending to ensure national security. They emphasize the importance of a powerful military to protect national interests both domestically and internationally.

Liberal/Socialist Policies:

Economic Equality: Liberals and socialists focus on reducing economic inequality by increasing government intervention in the economy. This can include progressive taxation, where higher earners pay more, and social safety nets to support the less fortunate.

Taxation: Liberals typically support higher taxes on corporations and the wealthy to fund social programs like healthcare, education, and welfare. Socialists may go further, advocating for the redistribution of wealth to ensure greater economic equality.

Role of Government: Liberals and socialists believe in a larger role for government in providing services that benefit the public, such as universal healthcare, public education, and environmental protection. Socialists, in particular, may support the nationalization of key industries (e.g., energy, healthcare) to ensure that these services are run in the interest of the public rather than for profit.

Social Issues: Liberals tend to support progressive social policies, advocating for individual rights and freedoms, such as abortion rights, LGBTQ+ rights, and gender equality. They emphasize diversity and inclusion as important societal values.

National Defense: While liberals generally support a strong national defense, they often prioritize diplomatic solutions over military intervention and advocate for reduced military spending in favor of funding domestic programs. Socialists are even more likely to advocate for demilitarization and non-interventionist foreign policies.

Summary of Key Differences:

Economic Policies: Conservatives advocate for free markets and less regulation, while liberals and socialists favor government intervention to address inequality.

Taxation: Conservatives push for lower taxes, while liberals and socialists support higher taxes on the wealthy to fund social programs.

Role of Government: Conservatives prefer limited government involvement, whereas liberals and socialists believe in a larger, more active government to address social and economic issues.

Social Policies: Conservatives uphold traditional values, while liberals and socialists push for progressive reforms and inclusivity.

Defense: Conservatives emphasize military strength, while liberals and socialists often prioritize diplomacy and reducing military expenditure.

These ideological differences shape the contrasting policies of conservative and liberal/socialist groups in various countries, including the U.S., Canada, and Europe.

WHAT COUNTRIES HAVE HIGH CAPITAL GAINS TAX LAWS?

Countries with high capital gains tax laws typically impose significant taxes on the profits made from selling investments such as stocks, bonds, property, and other assets. These taxes can vary widely, especially when it comes to long-term vs. short-term investments or based on individual vs. corporate gains. Here are some countries known for their relatively high capital gains tax rates:

1. Denmark

Capital Gains Tax Rate: Up to 42%

Denmark has one of the highest capital gains tax rates in the world, applying high taxes on income from both investments and personal capital gains.

2. Finland

Capital Gains Tax Rate: Up to 34%

Finland applies a capital gains tax rate of up to 34%, depending on the amount of income, with higher taxes applied to larger gains.

3. France

Capital Gains Tax Rate: 30%

France has a flat capital gains tax rate of 30%, which includes social contributions, making it one of the higher rates in Europe.

4. Sweden

Capital Gains Tax Rate: 30%

Sweden applies a flat 30% capital gains tax rate, which is considered one of the highest in Europe.

5. Ireland

Capital Gains Tax Rate: 33%

Ireland imposes a capital gains tax of 33%, making it one of the higher rates within the European Union.

6. Norway

Capital Gains Tax Rate: Up to 31.68%

In Norway, capital gains are taxed as ordinary income at rates of up to 31.68%, depending on the income bracket.

7. Spain

Capital Gains Tax Rate: Up to 28%

Spain taxes capital gains progressively based on income, with a maximum rate of 28%.

8. Japan

Capital Gains Tax Rate: 20.315%

Japan imposes a flat capital gains tax of 20.315% on profits from selling securities, which includes a surtax for disaster recovery.

9. Canada

Capital Gains Tax Rate: 50% of the gain is taxable at the taxpayer's marginal rate

Although Canada doesn’t tax the full capital gain, 50% of the gain is subject to tax at the taxpayer's marginal rate. This can lead to high effective rates depending on the individual's income bracket.

10. Australia

Capital Gains Tax Rate: Marginal income tax rate (with a 50% discount for long-term holdings)

In Australia, capital gains are added to income and taxed at the individual's marginal rate, but a 50% discount applies to assets held for more than a year.

11. Germany

Capital Gains Tax Rate: 25% flat rate (plus solidarity surcharge)

Germany applies a 25% flat tax on capital gains, with an additional solidarity surcharge of 5.5%.

These countries typically impose higher capital gains taxes compared to global averages, especially for higher-income individuals and large investment profits. However, many countries also offer specific exemptions, discounts, or favorable rates for long-term investments or retirement accounts, which can reduce the overall tax burden.